Astraea Solutions, LLC

Tennessee Qualified Income Trust (QIT) Form - Conservator Version

Tennessee Qualified Income Trust (QIT) Form - Conservator Version

Couldn't load pickup availability

Please read this description carefully and make sure that these forms fit your situation. A Qualified Income Trust (QIT), also called a Miller Trust, may be required to establish income eligibility in Tennessee when an applicant’s income is over TennCare's eligibility limit. This version of the form is designed for use by the Conservator of a TennCare applicant.

What’s Included:

Tennessee QIT Form – Conservator Version (Editable PDF)

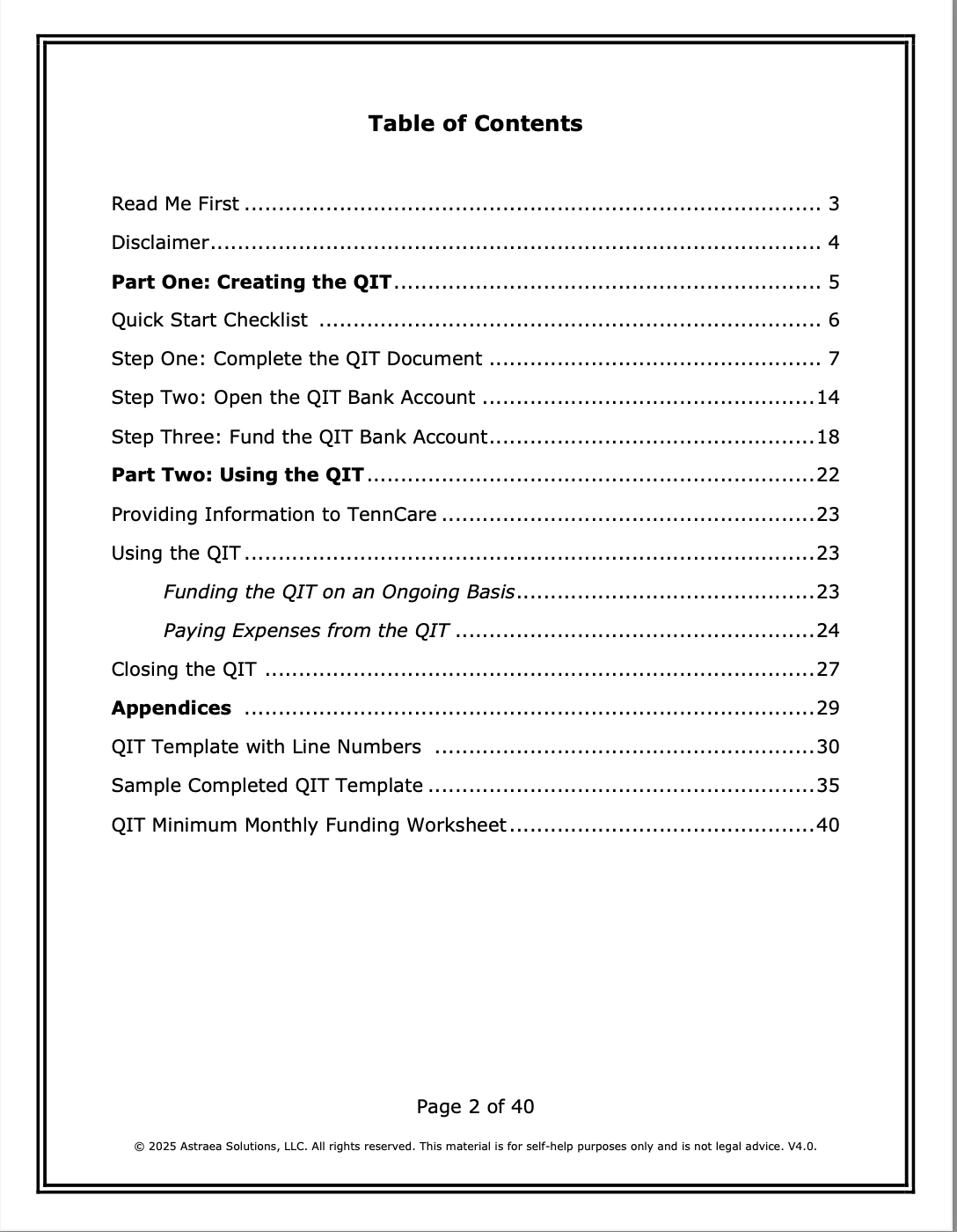

Tennessee QIT Toolkit - Conservator Version (PDF)- 40 pages of information

- Step-by-step instructions

- Information on setting up and funding a QIT bank account

- FAQ’s and explanations of common mistakes and how to avoid them

- Supplemental information on using the QIT trust once it has been set up, working with TennCare, and obligations once the trust is terminated

Format: Digital download (PDF)

Delivery: Instant download after checkout + emailed link

Do Not Use This Version If:

A Power of Attorney will sign the QIT (use Power of Attorney version)

The Applicant will sign the QIT (use Applicant version)

Anyone other than a Conservator is signing the QIT

Important Disclaimer - For Self-Help Use Only

This package is provided as a self-help resource. Medicaid eligibility is complex and fact-specific. You should consult with a qualified attorney if you have questions about whether this package is appropriate for your circumstances or if you need legal advice about your eligibility or obligations. By using this form, you acknowledge and agree to the following:

No Attorney–Client Relationship

The availability or use of this form does not create an attorney–client relationship between you and the provider of this document.

No legal representation, advice, or advocacy is being offered.

Not Legal Advice

This form and any accompanying instructions or materials are for informational purposes only.

They are not a substitute for professional legal advice. Laws vary, and application of the law depends on the unique facts of each case.

Consult a Qualified Attorney

Because every situation is different, you should consult with a qualified attorney licensed in Tennessee to ensure this document is appropriate for your needs.

Only a licensed attorney can provide you with advice regarding your rights, obligations, or the legal effect of this document.

Responsibility of the User

You are solely responsible for reviewing, completing, and executing the form correctly.

You are responsible for how you use this form and any outcomes that result.